Genuine Success Stories Using Equity Release Mortgages

Genuine Success Stories Using Equity Release Mortgages

Blog Article

Discovering the Different Sorts Of Equity Release Mortgages Available Today

Equity Release home mortgages present various choices for house owners aged 55 and over. equity release mortgages. These financial items accommodate various needs and choices, permitting people to gain access to funds from their residential or commercial property. From lifetime home loans to shared gratitude home mortgages, each type uses distinctive advantages. Recognizing these options is essential for making notified decisions. What variables should one take into consideration when picking the most suitable equity Release plan? The information that adhere to may clarify this crucial topic

Recognizing Equity Release Mortgages

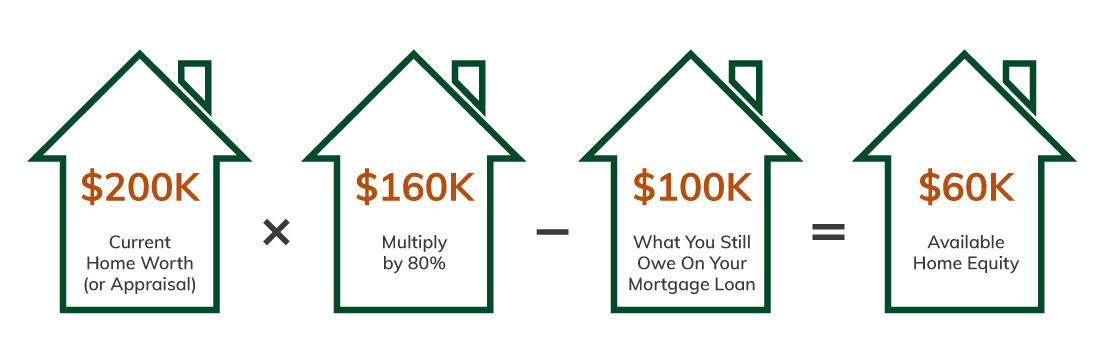

Equity Release home loans supply home owners, commonly those aged 55 and over, with a method to access the worth connected up in their residential property without needing to sell it. This financial choice allows people to convert a section of their home equity into cash money, which can be used for various objectives, such as home enhancements, paying off financial obligations, or funding retirement.Equity Release can take various kinds, however it basically entails borrowing versus the value of the home while retaining possession. Homeowners can select to receive a round figure or a series of smaller repayments, relying on their financial needs and preferences.Additionally, the quantity offered for Release is affected by the home's value, the house owner's age, and certain lender criteria. Generally, comprehending equity Release home mortgages is necessary for house owners to make enlightened choices about using their home's equity while considering the lasting effects.

Lifetime Mortgages

Lifetime home mortgages stand for among one of the most popular types of equity Release. This monetary item permits home owners, commonly aged 55 or older, to borrow versus the value of their residential property while retaining ownership. The car loan, which is protected against the home, accumulates passion over time however does not require regular monthly repayments. Instead, the finance and built up rate of interest are paid off when the home owner passes away or moves into lasting care.Lifetime mortgages supply versatility, as borrowers can choose to get a round figure or select a drawdown center, accessing funds as needed. Significantly, several plans included a no-negative-equity assurance, making certain that customers will certainly never owe greater than the value of their home. This attribute supplies satisfaction, allowing individuals to appreciate their retired life without the concern of diminishing their estate. Generally, lifetime mortgages function as a feasible option for those seeking financial backing in later life.

Home Reversion Program

Drawdown Life Time Mortgages

While numerous property owners seek ways to access their wealth, drawdown lifetime mortgages offer a versatile choice that allows people to Release funds slowly. This sort of equity Release home loan makes it possible for home owners to obtain versus the value of their home while maintaining possession. Unlike standard life time home loans, drawdown plans permit consumers to access a section of their equity upfront and take out extra funds as needed, as much as a fixed limit.This function can be particularly beneficial for those who desire to handle their finances meticulously, as it decreases rate of interest buildup by only charging interest on the amounts attracted. Furthermore, drawdown life time home loans often include a "no adverse equity assurance," guaranteeing that consumers will certainly never owe greater than their home's worth. This option fits retired people that desire economic safety and adaptability, enabling them to meet unanticipated expenditures or maintain their lifestyle without having to offer their property.

Boosted Life Time Mortgages

Enhanced Life time Home mortgages provide unique benefits for eligible home owners looking for to Release equity from their residential or commercial properties. Comprehending the qualification standards is essential, as it identifies that can gain from these specialized loans. It is likewise important to examine the prospective drawbacks associated with enhanced alternatives, ensuring an all-round perspective on their use.

Eligibility Standards Described

Understanding the qualification standards for Enhanced Life time Mortgages is crucial for possible candidates seeking to access the equity in their homes. Generally, applicants have to be aged 55 or older, as this age need is typical in the equity Release market. Homeowners must have a property valued at a minimal limit, which can differ by loan provider. Notably, the residential property has to be their main home and in excellent condition. Lenders frequently analyze the homeowner's wellness condition, as certain health and wellness problems might improve qualification and benefits. Additionally, applicants need to not have existing substantial financial debts secured against the residential or commercial property. Satisfying these criteria allows people to check out Enhanced Lifetime Home loans as a viable option for accessing funds locked up in their homes.

Advantages of Improved Home Mortgages

After clarifying the qualification criteria, it comes to be apparent that Improved Lifetime Mortgages offer a number of considerable advantages for property owners aiming to utilize their residential or commercial property equity. Largely, they give access to a larger car loan amount contrasted to basic lifetime home mortgages, benefiting those with health conditions or age-related factors this article that boost their life expectancy risk. This enhanced loaning capability allows homeowners to satisfy various financial demands, such as home improvements or retirement costs. Additionally, these mortgages usually come with flexible settlement alternatives, allowing consumers to manage their finances a lot more effectively. The no-negative-equity guarantee even more assures that property owners will never ever owe greater than their property's value, providing assurance. Generally, Enhanced Lifetime Home mortgages provide an engaging option for eligible property owners seeking economic options.

Possible Drawbacks Thought About

While Improved Life time Home mortgages supply countless advantages, prospective drawbacks require cautious factor to consider. One significant problem is the effect on inheritance; the equity released decreases the value of the estate delegated recipients. In addition, these home loans can accumulate substantial passion gradually, bring about a substantial financial debt that might go beyond the original loan amount. There may additionally be limitations on property modifications or rental, limiting property owners' adaptability. Additionally, enhanced products usually call for specific health problems, meaning not all homeowners will certify. Managing the charges and fees associated with these home mortgages can be complicated, possibly leading to unexpected prices. Therefore, people should extensively evaluate their situation and consult economic experts prior to continuing.

Shared Recognition Home Mortgages

Shared Admiration Home mortgages represent an unique economic setup that allows house owners to access equity while sharing future residential property worth raises with the loan provider. This technique uses possible benefits such as decreased month-to-month repayments, but it likewise features drawbacks that need to be meticulously considered. Understanding the qualification needs is necessary for those thinking about this alternative.

Principle Overview

Equity Release home loans, especially in the type of common recognition home loans, use home owners an unique monetary option that enables them to accessibility funds by leveraging the worth of their home. In this setup, a lender supplies a lending to the property owner, which is generally settled through a share of the property's future gratitude in value. This suggests that when the property owner markets the residential or commercial property or dies, the lender gets a portion of the boosted value, rather than just the first lending amount. Shared appreciation mortgages can be appealing for those looking to supplement their revenue or money significant expenditures while retaining possession of their home. Nevertheless, the economic ramifications of common admiration have to be meticulously considered by potential consumers.

Advantages and Drawbacks

Common gratitude home mortgages can give considerable economic benefits, they likewise come with noteworthy disadvantages that potential customers ought to consider. These mortgages enable property owners to access equity in their residential properties while sharing why not look here a section of any kind of future recognition with the lender. This plan can be helpful throughout times of increasing residential property values, using significant funds without regular monthly settlements. The primary drawback is the potential loss of equity; home owners may finish up with substantially minimized inheritance for successors. Additionally, the complexity of the terms can cause misconceptions regarding payment obligations and the portion of appreciation owed. Therefore, it is vital for customers to consider these aspects carefully before committing to a common gratitude mortgage.

Qualification Demands

What criteria must property owners satisfy to receive a common recognition mortgage? Largely, candidates need to be at the very least 55 years old, ensuring they are within the target demographic for equity Release items. In addition, the building must be their main house and typically valued above a specified minimum threshold, frequently around ? 100,000. Lenders additionally examine the homeowner's monetary circumstances, consisting of income and exceptional financial obligations, to identify they can handle the home loan responsibly. Importantly, the property must remain in good condition and devoid of significant lawful encumbrances. Home owners should also have a clear understanding of the terms, consisting of just how recognition will be shown to the lender upon sale or transfer of the building, as this impacts overall returns.

Picking the Right Equity Release Choice

Regularly Asked Questions

What Age Do I Required to Be for Equity Release?

The age need for equity Release generally starts at 55 for many plans. Nevertheless, some service providers might use choices for those aged 60 and above, reflecting differing terms based upon individual scenarios and loan provider plans.

Will Equity Release Impact My Inheritance?

Equity Release can affect inheritance, as the quantity obtained plus rate of interest minimizes the estate's worth. Successors might get much less than expected, depending upon the building's recognition and the complete financial obligation at the time of check this site out passing.

Can I Move Residence With Equity Release?

The inquiry of relocating house with equity Release develops frequently. Normally, individuals can move their equity Release strategy to a new property, but particular terms may apply, needing appointment with the loan provider for support.

Exist Fees Related To Equity Release Mortgages?

Costs connected with equity Release home loans can include setup costs, valuation costs, and lawful costs. Additionally, there might be early repayment fees, which can impact the general cost and financial implications for the borrower.

Exactly How Does Equity Release Effect My Tax Circumstance?

Equity Release can influence one's tax obligation situation by potentially boosting taxable revenue, as released funds are taken into consideration resources. It normally does not sustain prompt tax obligation obligations, making it crucial to seek advice from a financial advisor for customized assistance.

Conclusion

In recap, the selection of equity Release home mortgages available today provides house owners aged 55 and over multiple paths to access their property's value - equity release mortgages. Whether opting for a lifetime mortgage, home reversion strategy, or other choices, each option presents unique advantages customized to private monetary demands. Careful consideration and assessment with a financial consultant are necessary to guarantee the selected equity Release service lines up with monetary situations and personal objectives, inevitably helping with notified decision-making for a safe and secure economic future. Equity Release home loans present different options for house owners aged 55 and over. Equity Release mortgages supply property owners, generally those aged 55 and over, with a method to access the value linked up in their home without requiring to market it. Boosted Life time Home loans supply unique benefits for qualified property owners seeking to Release equity from their buildings. Equity Release home mortgages, especially in the type of common recognition home loans, use home owners a distinct economic solution that permits them to gain access to funds by leveraging the value of their residential property. In recap, the selection of equity Release mortgages available today provides homeowners aged 55 and over numerous paths to access their building's value

Report this page